Christy Watt

Mortgage Agent

647-781-2474 | Email

My Blog

Your Personal Mortgage Shopper

Quick Links

Blog

Blog Post Categories

Announcements (0)Featured Realtor Listings (12)

Happily Ever After (4)

Industry News (1)

Private Lending (0)

Renewals (0)

Syndicate Mortgages (0)

Tips and Tricks (0)

Blog Post Archives

April 2017 (4)March 2017 (1)

February 2017 (1)

January 2017 (1)

September 2016 (1)

July 2016 (1)

May 2016 (1)

March 2016 (2)

October 2015 (1)

September 2015 (2)

July 2015 (2)

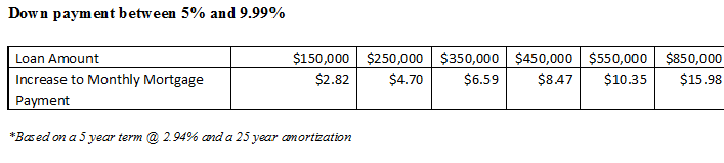

CMHC loan insurance is increasing as of March 17th . Keep in mind this is just CMHC that is increasing their premiums and we shall have to wait and see if the other insurers follow suit. Yes, this means that as of March 17th it is going to be more expensive for anyone putting less than 20% down. No, the increase to your monthly mortgage payment is not as little as $5 a month when you consider the average Toronto home price. The media is playing down the cost as they are reading the same thing that everyone else is reading which is based on the average home price of a CMHC insured mortgage in Canada of $245,000. Unfortunately, the prices in the GTA and Toronto are a lot higher than $245,000. Here is a chart that they have put out for what they deem to be the average transaction in Canada for 2016.

The overall average Toronto selling price for 2016 was approximately $730,000. Here is my own chart to give you an idea of what this change means based on the average Toronto transaction.

Down payment of 8% (CMHC said this was the approximate average in 2016)

|

Purchase Price |

$730,000 |

|

Down Payment |

$58,400 |

|

CMHC Insurance |

26,864 |

|

Total Mortgage |

$698,464 |

|

Monthly Mortgage Payment |

$3,287.56 |

|

Increase to Monthly Mortgage |

$12.65 |

|

Payment |

|

An increase of $12.65 to your monthly payment should not induce panic. It will impact how much you qualify for monthly but it will be marginal. If you are shopping for homes and this difference does cause you stress, you should talk to a mortgage professional that can help you work out a budget that takes into account monthly savings for retirement and life events alongside your monthly mortgage payment and determine a price point that helps you end up in your comfort zone.